A Comprehensive Comparison: QuickBooks vs FreshBooks vs Wave

In the world of small business accounting software, choosing the right platform can significantly influence your financial management efficiency and overall business growth. Among the most popular options are QuickBooks, FreshBooks, and Wave—each offering unique features tailored to different business needs.

Understanding how these three platforms compare across various parameters is essential for entrepreneurs, freelancers, and small business owners striving for streamlined bookkeeping, invoicing, and financial reporting.

This article provides a detailed analysis of QuickBooks vs FreshBooks vs Wave, helping you make an informed decision based on your specific requirements.

Overview of QuickBooks, FreshBooks, and Wave

QuickBooks, FreshBooks, and Wave are cloud-based accounting solutions designed to simplify financial processes. While they share core functionalities like expense tracking and invoicing, each platform caters to different types of users with distinct features and pricing structures. QuickBooks is known for its comprehensive accounting capabilities suitable for growing businesses. FreshBooks emphasizes user-friendly invoicing and time tracking ideal for service providers. Wave offers free accounting tools targeted at small businesses with basic needs. Recognizing their individual strengths and limitations will help you select the best software to support your business operations.

User Interface and Ease of Use

When comparing QuickBooks vs FreshBooks vs Wave, user interface and ease of use are critical factors that influence how efficiently users can navigate the platform. QuickBooks boasts a robust interface packed with features but can be overwhelming for beginners due to its extensive options. Conversely, FreshBooks offers a highly intuitive design focused on simplicity, making it accessible even for users unfamiliar with accounting software. Wave’s interface is straightforward, emphasizing ease of access for basic accounting tasks without sacrificing functionality.

QuickBooks: Complex dashboard with detailed menus; requires some learning curve but offers comprehensive control.

FreshBooks: Clean, minimalistic interface; ideal for non-accountants needing quick setup.

Wave: Simple navigation; great for small teams or solo entrepreneurs who want quick access to essential features.

The choice largely depends on your comfort level with technology—if you prefer a powerful tool with many features despite a steeper learning curve, QuickBooks could be suitable. For those seeking simplicity without sacrificing functionality, FreshBooks or Wave might be better options.

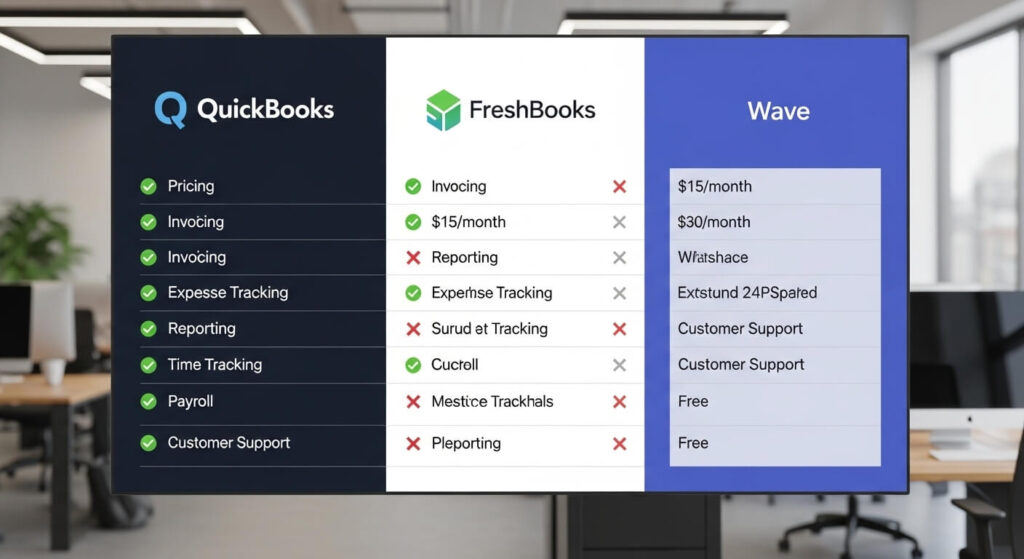

Pricing Structures and Value

Pricing is often decisive when selecting between QuickBooks vs FreshBooks vs Wave because each platform offers distinct plans tailored to different budgets. QuickBooks provides tiered subscription plans ranging from simple self-employed options to more advanced packages suited for growing businesses requiring inventory management or payroll integration. FreshBooks operates on a subscription model that primarily charges based on the number of clients or billable projects you manage monthly—making it predictable but potentially costly as your client list expands. Wave stands out by offering free core accounting features such as income & expense tracking, invoicing, and receipt scanning; however, optional paid services like payment processing come at additional costs.

QuickBooks: Multiple tiers starting at around $15/month; scalable as your business grows.

FreshBooks: Plans starting at approximately $15/month; increases with added clients or project complexity.

Wave: Free basic plan; optional paid add-ons (e.g., credit card processing) available.

Ultimately, if budget constraints are significant yet you require advanced features like inventory tracking or payroll management, QuickBooks may offer better scalability despite higher costs. For freelancers or sole proprietors with modest needs, Wave’s free model provides excellent value.

Core Accounting Features

The core functionalities offered by each platform determine how well they meet fundamental bookkeeping needs. All three platforms provide invoice creation, expense tracking, financial reporting, and bank account integrations—crucial components for accurate recordkeeping. However, their depth varies considerably.

QuickBooks excels in comprehensive accounting functions such as inventory management, sales tax calculation, payroll processing (additional fee), and detailed financial reports suitable for tax preparation or investor review. FreshBooks emphasizes easy-to-use invoicing combined with time-tracking features vital for service-based businesses but has limited inventory management capabilities. Wave covers essential accounting essentials but lacks advanced features like payroll unless you opt into paid services.

QuickBooks: Advanced reporting tools; inventory management; integrated payroll (extra fee).

FreshBooks: Focused on invoicing & time tracking; limited inventory handling.

Wave: Basic bookkeeping functions; no built-in payroll unless paid separately.

Choosing among them depends on your operational scope—if managing complex finances is necessary, QuickBooks stands out; if simple billing suffices, FreshBooks or Wave may be adequate.

Invoicing Capabilities

Invoicing is a fundamental feature in small business accounting software—and it varies significantly among QuickBooks vs FreshBooks vs Wave. QuickBooks offers customizable invoices with automated payment reminders and multi-currency support—ideal for businesses dealing internationally or needing professional branding options. FreshBooks simplifies invoice creation through pre-designed templates that allow recurring billing and automated late payment notices—perfectly suited for freelancers who bill regularly after completing projects. Wave provides straightforward invoice templates that can be customized easily but lacks some automation features found in competitors.

QuickBooks: Fully customizable invoices with automation options.

FreshBooks: Easy-to-create recurring invoices with professional templates.

Wave: Basic invoice customization; manual follow-up necessary.

Your invoicing needs should guide your choice here: if automation saves time is crucial to your workflow—especially in high-volume billing—QuickBooks or Freshbooks offer more advanced options compared to Wave’s simplicity.

Payroll Integration and Tax Support

Payroll management remains a pivotal aspect of small business finance handling—especially when considering Quickbooks vs Freshbooks vs Wave. Quickbooks provides robust payroll services integrated directly into its platform (additional cost), including automatic tax calculations and direct deposit options—a major advantage for growing companies needing compliance support. FreshBooks recently introduced integrated payroll features in select regions but generally relies on third-party solutions; it is less comprehensive than QuickBook’s offering. Wave offers free basic payroll services in certain regions but charges extra for full-featured payroll processing depending on location requirements.

Quickbooks: Full-service payroll with tax calculations included.

Freshbooks: Limited payroll options via third-party integrations.

Wave: Free basic payroll services where available; full service comes at an extra fee.

Deciding which platform suits your payroll needs hinges on whether you prioritize automation and compliance assistance—making Quickbooks the clear leader—or if minimal payroll support suffices initially.

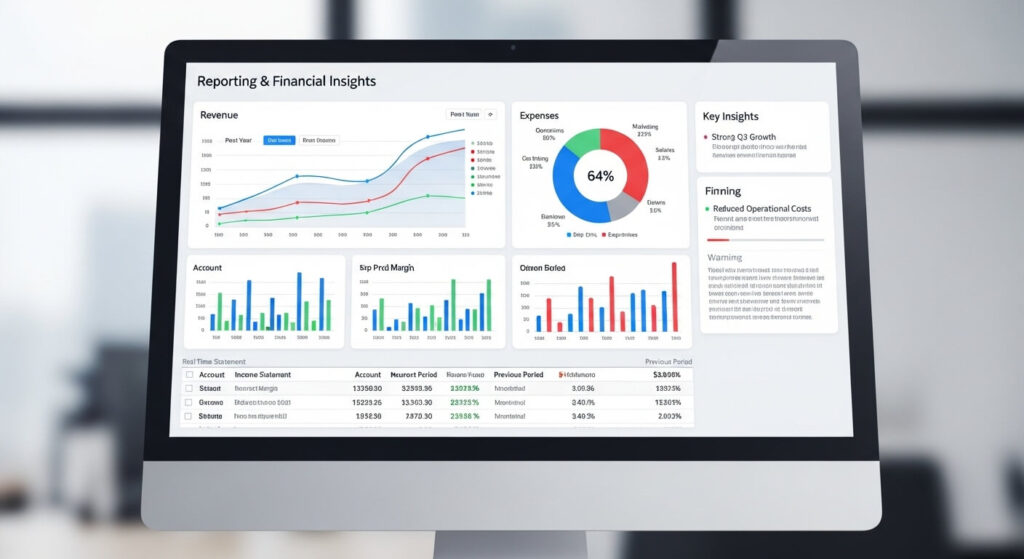

Reporting & Financial Insights

Accurate reporting informs strategic decisions—and this aspect varies widely among these platforms. QuickBook’s detailed reports include profit & loss statements, balance sheets, cash flow analyses—all customizable based on specific periods or segments of your business data—which makes it preferable for detailed financial analysis. FreshBoodks offers simplified reports focusing mainly on invoices sent and payments received but lacks some depth needed by larger enterprises or those preparing taxes extensively. Wave delivers basic reporting functionalities suitable for straightforward bookkeeping but does not match the analytical depth provided by Quickbooks.

Quickbooks: Extensive report customization options; valuable insights into business health.

Freshbooks: Basic reporting mainly centered around billing activities.

Wave: Fundamental reports sufficient for small-scale operations but limited analytics tools.

If your goal involves thorough financial analysis or growth planning supported by detailed reports—and scalability matters—Quickbooks emerges as the most capable option among the three.

Customer Support & Resources

Reliable customer support can make or break your experience with any accounting software platform—and expectations differ across these providers. QuickBook offers extensive resources including live chat support (premium plans), phone assistance (higher-tier plans), comprehensive knowledge bases, tutorials, and community forums aimed at resolving complex issues swiftly. FreshBoodks prioritizes user-friendliness with email support during business hours along with rich online documentation suited mainly for onboarding questions rather than technical troubleshooting under tight deadlines. Wave provides free email-based customer service along with an active online community but lacks 24/7 live support unless opting into paid plans.

Quickbooks: Multi-channel support including phone & chat depending on plan.

Freshbooks: Email support plus online tutorials; limited live contact options.

Wave: Free email support only; paid plans unlock additional channels.

Choosing a provider depends heavily on your need for prompt assistance—if rapid response times are critical during busy periods or tax season —consider platforms like Quickbooks that offer broader support channels.

Final Thoughts: Making Your Choice

In evaluating Quickbooks vs Freshbooks vs Wave comprehensively—from ease of use through pricing structures—the best solution ultimately hinges on your specific business needs. If you operate a medium-sized enterprise requiring sophisticated accounting tools—including inventory management and full payroll integration—Quickbooks stands out as the most robust option despite its higher price point. For freelancers or small service providers seeking simplicity combined with efficient invoicing capabilities without heavy investment in advanced features—Freshbooks offers an intuitive experience at competitive rates. Meanwhile, if budget constraints are tight yet foundational bookkeeping functions are still necessary—you may find that Wave’s free plan adequately supports your initial growth phase while offering room to upgrade later as your needs evolve.

Conclution

Analyzing the Best Fit: Which Platform Serves You?

Choosing between Quickbooks vs Freshbooks vs Wave isn’t solely about current operational requirements—it also involves considering future scalability and integration possibilities within your existing workflow environments. Each platform has carved out niches based on their strengths: quick setup and affordability in Wave’s case; deep financial insights from Quickbooks’ extensive reporting tools; user-friendly interfaces tailored toward non-accountants via Freshbook’s design philosophy—that’s why aligning these attributes with your long-term goals ensures optimal results when selecting software suited to your business journey.