FreshBooks vs. QuickBooks: Which Accounting Software Reigns Supreme for Your Business?

Running a small business asks for smart money moves. Picking the right accounting software helps keep everything in order. It makes a big difference between smooth operations and a tangled mess. FreshBooks and QuickBooks lead the pack in this area. Both offer many features for different business needs. This article will compare FreshBooks and QuickBooks side-by-side. We’ll look at their main tools, costs, ease of use, and unique strong points. This way, you can pick the best option.

FreshBooks vs. QuickBooks: Feature Breakdown

Invoicing and Billing

FreshBooks’ Invoicing Capabilities

FreshBooks makes sending invoices easy. Its interface is simple and clean. You can set up recurring invoices for regular clients. Automated payment reminders mean you don’t chase after late payments. You can also customize how your invoices look. This software works best for businesses that sell services. FreshBooks really speeds up the invoicing for freelancers and agencies. Imagine sending a professional invoice in just a few clicks.

QuickBooks’ Invoicing Strengths

QuickBooks offers a full set of invoicing tools. You can send many invoices at once. Custom fields let you add specific details to each bill. It links easily with different payment methods. Businesses with complex billing often find QuickBooks a perfect fit. It handles everything from quick sales slips to detailed project bills. This flexibility helps many different company types.

Expense Tracking and Management

How FreshBooks Handles Expenses

FreshBooks helps you track money going out. You can snap pictures of receipts using your phone app. It sorts your expenses into categories automatically. Paying bills through the system is also simple. A small business owner can track costs on the go with FreshBooks. This means less paper and more organized records.

QuickBooks’ Expense Management Tools

QuickBooks connects directly to your bank accounts. This pulls in all your transactions. It helps manage bills and run useful spending reports. Its bank reconciliation tool saves a lot of time. This feature also helps avoid mistakes in your expense records. It gives a clear picture of where your money goes.

Financial Reporting and Analytics

FreshBooks’ Reporting Suite

FreshBooks offers key reports to understand your money. You can see your profit and loss statements. Reports show which clients owe you money and for how long. It also breaks down sales by client. These reports give service businesses a good look at their cash flow. You can easily spot how profitable your work is.

QuickBooks’ Robust Reporting

QuickBooks provides many detailed reports. You can get balance sheets, income statements, and cash flow reports. It also lets you create custom reports. These deep financial reports help businesses make smart choices. They also help keep you in line with tax rules. Knowing your numbers is a real asset.

Time Tracking and Project Management

FreshBooks for Project-Based Businesses

FreshBooks has built-in time tracking. You can set budgets for projects. It also lets you work with clients on project details. A freelance designer might use FreshBooks to log hours for multiple clients. This helps them stay on budget and bill accurately. It keeps everything organized in one spot.

QuickBooks’ Time Tracking Options

QuickBooks Time, once called TSheets, works well with QuickBooks. This integration offers advanced features for payroll and project costs. Businesses can track employee hours with great accuracy. This helps with proper pay and understanding project profits. It ensures every minute counts.

User Experience and Ease of Use

Navigating FreshBooks

FreshBooks is known for its friendly design. It’s easy to use, especially for people who are not accountants. The setup is simple, and the interface feels clean. Many small business owners found FreshBooks quick to pick up. They say it makes managing finances less stressful.

QuickBooks’ Learning Curve

QuickBooks can seem tricky at first for new users. Its many features make it powerful, but also a bit complex. However, once you learn it, the power is clear. New users should check out the tutorials. Support resources also help you get started with QuickBooks faster.

Pricing and Plans

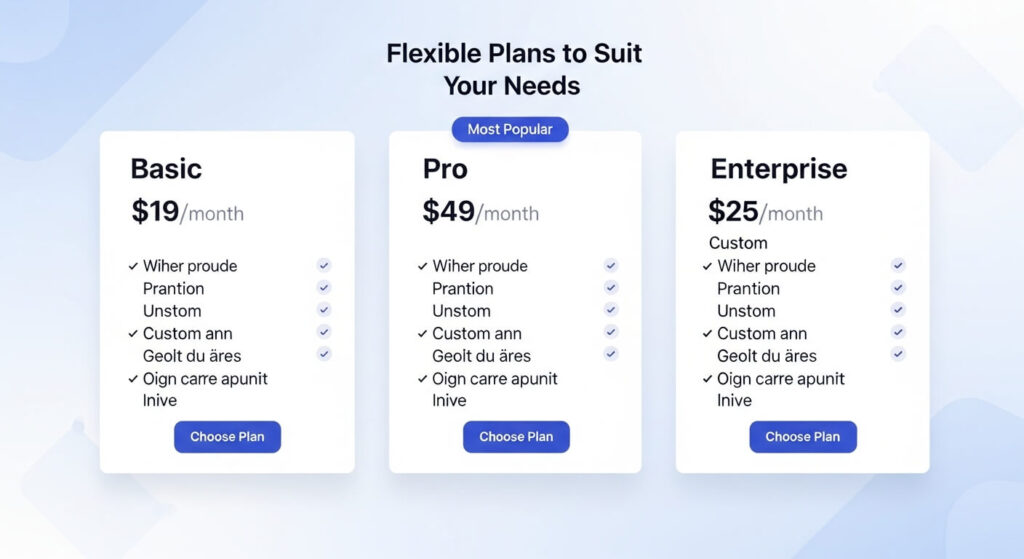

FreshBooks Pricing Tiers

FreshBooks offers several pricing plans. Each plan includes different features. These plans are designed for various business sizes. Consider your company’s scale when looking at the cost. FreshBooks aims to be cost-effective for different kinds of needs.

QuickBooks Pricing Structure

QuickBooks has several product lines. Simple Start, Essentials, Plus, and Advanced are some options. Each plan comes with its own price and features. The system scales up as your business grows. This allows you to pick a plan that fits today and tomorrow.

Integrations and Ecosystem

FreshBooks Integrations

FreshBooks connects with many other popular apps. These include payment processors and customer relationship tools. Project management apps also link up. Integrating FreshBooks with your other business tools can save time. It helps make daily tasks run smoother.

QuickBooks’ Extensive Integrations

QuickBooks connects with a huge number of apps. It can act as a main hub for your business. Imagine linking QuickBooks with your online store. Or connect it to your inventory system. This broad connectivity helps automate many tasks.

Who Should Use FreshBooks?

FreshBooks works best for freelancers and sole owners. It’s also great for service-based businesses. If you have simple accounting needs, this might be your pick. A small marketing agency can thrive with FreshBooks. It helps them focus on client work, not complex books.

Who Should Use QuickBooks?

QuickBooks is for businesses needing more advanced accounting. If you handle inventory, it’s a strong choice. It also offers very strong reporting. A growing retail business often uses QuickBooks for all its money tasks. It handles detailed financial management needs.

Conclusion and Key Takeaways

Choosing between FreshBooks and QuickBooks depends on your business. FreshBooks is often easier and great for service-based companies. QuickBooks offers more power and features for complex needs. Think about what your business truly needs today. Also, think about where you want it to be tomorrow. A smart move is to try a free trial of each. See which accounting software feels right for you.