Managing money is a big challenge for small businesses and freelancers. Keeping track of income and outgoings is vital. Good accounting software ensures your business stays profitable and follows all tax rules. It takes away much of the stress of financial tracking.

FreshBooks and Quicken stand out as two popular choices in the market. Each offers unique strengths for different users. This article will give you a clear look at both to help you pick the best fit. Your financial health depends on making a smart decision.

We will explore key differences between these two solutions. Expect to learn about ease of use, feature sets, pricing plans, and who each software helps the most. By the end, you will know which tool best serves your business goals.

Understanding Your Needs: Before You Choose

Before you dive into software specifics, think about your own financial setup. What do you need an accounting tool to do for you? Knowing your requirements first helps narrow down the best option. This step is crucial for making a choice you will be happy with.

Freelancer vs. Small Business Needs

A solo freelancer often needs simple tools for invoicing and tracking expenses. They might mainly focus on income and expenses for tax time. A growing small business, though, has more complex needs. This could include managing payroll, handling inventory, or creating detailed financial reports.

Small businesses might also require team collaboration features. They often need robust tools for managing cash flow across multiple projects. Understanding your current size and future plans is very important. Your business structure heavily impacts the features you will use most.

Budget and Scalability Considerations

How much are you ready to spend each month on accounting software? Your budget plays a significant role in your choice. Some solutions offer basic plans at a low cost, while others come with a higher price tag for advanced features. Always compare what you get for the money.

Consider your business’s growth path too. Will your accounting needs become more complex over time? Choosing software that can grow with you saves you from switching later. Scalability means the software can handle more transactions or users as your business expands.

Technical Proficiency and User Experience

How comfortable are you with new software? Some people prefer a very simple, guided experience. Others do not mind a steeper learning curve for more powerful tools. The software you pick should match your comfort level with technology.

A user-friendly interface makes daily tasks much easier. You want to spend less time figuring out the software and more time running your business. Test out free trials to see which one feels best to navigate. Good user experience boosts productivity and reduces frustration.

FreshBooks: Designed for Service-Based Businesses and Freelancers

FreshBooks specifically caters to service-based businesses, independent contractors, and freelancers. It aims to simplify the financial aspects of running such a business. Its design puts a premium on ease of use and getting clients to pay you faster. Many users find its straightforward approach refreshing.

Invoicing and Payments Made Easy

FreshBooks shines with its powerful invoicing features. You can customize invoices to match your brand, making a professional impression. Sending recurring invoices for ongoing clients is simple. Clients can pay you online directly from the invoice, speeding up payment times.

The software also sends automated payment reminders. This helps reduce late payments without you having to chase clients. FreshBooks helps you keep a steady cash flow. It ensures your hard work gets paid promptly.

Time Tracking and Project Management

For those who bill by the hour, FreshBooks offers integrated time tracking. You can track hours spent on specific projects or clients. These tracked hours easily convert into billable items on your invoices. This saves time and ensures accuracy.

It also helps manage projects by letting you see how profitable each one is. You can assign tasks and set budgets for projects. This gives you a clear view of your project’s financial health. Understanding project costs is key for sustainable growth.

Expense Management and Receipt Capture

Keeping track of expenses is easy with FreshBooks. You can connect your bank accounts and credit cards to import transactions automatically. Categorizing expenses helps you stay organized for tax purposes. Its mobile app lets you snap photos of receipts.

This feature ensures no expense goes unrecorded. You can easily attach receipts to specific transactions. Accurate expense tracking helps you see where your money goes. It also makes tax deductions much simpler.

Reporting and Tax Readiness

FreshBooks provides a range of reports to keep you informed. You can generate profit and loss statements, expense reports, and accounts receivable aging reports. These reports offer insights into your business’s financial performance. They help you make smarter decisions.

For tax time, FreshBooks simplifies preparation. All your income and expense data is organized and ready. You can easily share reports with your accountant. This makes filing your taxes much less of a headache.

Quicken: Robust Personal and Small Business Financial Management

Quicken has a long history, traditionally known for personal finance management. However, it also provides tools for small business owners. It focuses on giving you a complete view of all your finances in one place. This includes both your personal and business accounts.

Comprehensive Financial Tracking

Quicken excels at connecting to all your financial accounts. It links to banks, credit cards, loans, and even investment accounts. This means all your transactions download automatically. You get a single dashboard showing your entire financial picture.

This comprehensive view helps you see where your money is going. It covers everything from your daily spending to your long-term savings. You gain a strong grasp of your money. This holistic approach helps in making informed financial choices.

Budgeting and Planning Tools

Creating and sticking to a budget is a core strength of Quicken. Its robust budgeting features help you set spending limits and track against them. You can monitor your cash flow closely. This helps avoid overspending and reach financial goals.

Quicken also includes tools for debt reduction and investment tracking. You can manage your portfolio, track gains and losses, and plan for retirement. These features provide a deeper level of financial planning. They go beyond simple business accounting.

Small Business Accounting Features

While Quicken’s roots are in personal finance, it offers features for small businesses. You can create basic invoices and track customer payments. It handles expense tracking and categorization for your business transactions. This helps separate business and personal finances.

Quicken also provides basic reports tailored for small businesses. These include profit and loss reports. Keep in mind, its small business features are often best for very small operations. Businesses with complex needs might find it somewhat limited compared to dedicated business software.

Bill Payment and Cash Flow Management

Managing your bills is straightforward with Quicken. You can set up reminders for upcoming payments. It allows you to schedule payments directly from the software. This helps ensure you never miss a due date.

Monitoring your cash flow becomes easier too. You can see when money is coming in and going out. This helps prevent overdrafts and keeps your accounts healthy. Quicken gives you control over your financial obligations.

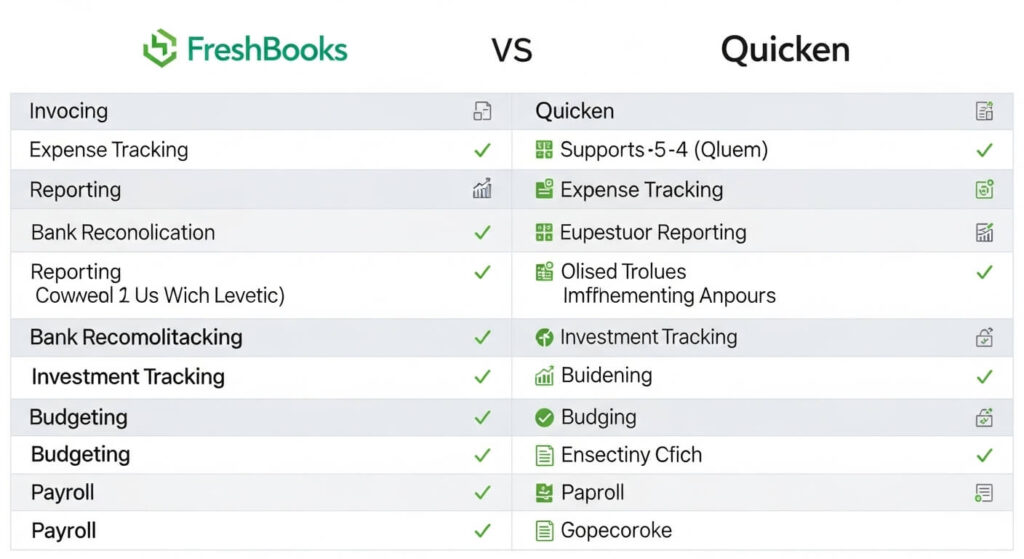

Feature-by-Feature Comparison: FreshBooks vs. Quicken

When looking at FreshBooks versus Quicken, several key areas show clear differences. Understanding these contrasts will guide your choice. Both are strong tools, but they serve different primary purposes.

Ease of Use and Onboarding

FreshBooks is well-known for its user-friendly interface. New users often find it very intuitive and easy to set up. Its design focuses on simplicity, making it quick to learn. Getting started with invoicing and expense tracking takes little time.

Quicken, with its broader feature set, can have a steeper learning curve. It offers more depth, which can feel overwhelming at first. However, once familiar, its comprehensive view is powerful. It may require more initial setup time.

Invoicing and Billing

FreshBooks excels in invoicing for service-based businesses. It offers highly customizable invoice templates and robust recurring billing options. Its direct payment processing and automated reminders are top-tier. Getting paid quickly is a main goal of FreshBooks.

Quicken provides basic invoicing capabilities suitable for simple needs. You can generate invoices and track payments. However, its customization options are less extensive. It might not be the best choice if invoicing is your primary daily task.

Expense Tracking and Receipt Management

Both platforms offer good expense tracking. FreshBooks uses bank connections and a mobile app for receipt capture. It organizes expenses neatly for service-based reporting. This makes it easy to categorize and attach proof of purchase.

Quicken also connects to bank and credit card accounts for automatic downloads. It allows for detailed categorization across personal and business finances. Its receipt management is effective. Both tools keep your spending organized.

Reporting and Analytics

FreshBooks offers clear, focused reports for service businesses. You get insights into profitability, client payments, and expenses. These reports are designed to help freelancers and small agencies understand their business health. They are easy to read and act upon.

Quicken provides extensive reporting across personal and business finances. Its strength lies in detailed financial planning reports. You can track net worth, investments, and complex budgets. For a unified view of all money matters, Quicken offers more depth.

Integrations and Ecosystem

FreshBooks integrates with a wide range of business apps. This includes payment gateways like Stripe and PayPal, CRM tools, and project management platforms. Its open API allows for flexible connections. This expands its functionality significantly.

Quicken has fewer direct business integrations compared to FreshBooks. Its ecosystem is more geared towards financial institutions and investment platforms. It works well within its own comprehensive financial management framework. If you need many third-party business app connections, FreshBooks might be better.

Pricing and Plans

FreshBooks offers several pricing tiers based on the number of billable clients. Plans typically start at a lower price for fewer clients and increase with more features. They often have discounts for annual subscriptions. Costs vary depending on your client load and desired features.

Quicken offers different versions, such as Starter, Deluxe, Premier, and Home & Business. The Home & Business version includes the small business features. Pricing depends on the specific edition and subscription length. Quicken typically costs more if you need its advanced investment or business tools.

Who Should Use FreshBooks?

FreshBooks is a clear winner for specific types of users. Its design and feature set cater to a distinct group. If your business model fits these criteria, FreshBooks will likely be a valuable asset. It simplifies the everyday tasks that service providers face.

Ideal User Profile

FreshBooks is perfect for freelancers, consultants, and independent contractors. Web designers, marketing agencies, lawyers, and creative professionals also benefit greatly. Any service-based business that bills clients for time or projects will find it useful. It’s built for those who value easy invoicing and project tracking.

Key Benefits for Service Providers

FreshBooks helps service providers get paid faster and manage projects better. Its time tracking seamlessly converts into invoices. Automated reminders reduce late payments. Plus, its simple expense tracking keeps your finances clear for tax season. It lets you focus more on client work and less on paperwork.

Who Should Use Quicken?

Quicken serves a different user base, often those needing a more integrated financial view. It excels when you want to combine personal and business money management. If your financial life is complex, Quicken can bring it all together.

Ideal User Profile

Quicken is best for individuals who want to manage their personal finances alongside a small business. This includes tracking investments, budgeting family expenses, and paying bills. Small business owners who also need robust personal finance tools will find it powerful. Anyone seeking a holistic view of their entire financial world fits this profile.

Key Benefits for Integrated Financial Management

Quicken provides a deep dive into all your finances. You can track net worth, manage debt, and plan for retirement, all in one place. Its comprehensive budgeting tools help you control spending across personal and business accounts. It offers a powerful solution for those who want total financial oversight.

Conclusion

FreshBooks and Quicken both manage finances, but they serve different masters. FreshBooks is the champion for service-based businesses and freelancers, focusing on smooth invoicing, time tracking, and expense management. Quicken, however, offers a broad platform for managing all personal and small business finances, excelling in budgeting and investment tracking.

Your choice should align with your core needs. If you run a service business and need simple, efficient invoicing and project tracking, FreshBooks is likely your best bet. If you seek a robust tool to manage both personal and a small business’s finances, including investments and detailed budgeting, then Quicken will serve you better.

Consider taking advantage of any free trials or demos offered by both software providers. Testing them out personally will confirm the best fit for your unique business operations and financial management style. Make an informed decision that empowers your financial future.