1 Does FreshBooks Integrate with QuickBooks? Your Guide to Seamless Financial Syncing

Managing money for your small business can be tricky. You might love FreshBooks for sending invoices and tracking time. It’s super easy to use, especially for freelancers or small service companies. At the same time, you may find QuickBooks better for deeper accounting tasks. It helps many businesses with more complex financial needs. This often makes business owners wonder: can these two powerhouse tools work together?

FreshBooks shines with its simple design and focus on client billing. QuickBooks is known as a solid choice for all-around accounting. It helps with payroll, detailed reports, and taxes. The good news is, while there isn’t a direct connection, you can still make them play nice. Effective workarounds and other solutions allow smooth data sharing. This helps you use the best features of both platforms.

0.1 Understanding the Need for Integration

Why Businesses Consider Integrating FreshBooks and QuickBooks

Businesses often grow into needing more powerful accounting tools. Many start with FreshBooks because its invoicing and client management are so simple. As they get bigger, they often add QuickBooks for its strong accounting functions. This creates a clear need to link the information between the two. You don’t want to type the same data twice.

Connecting these systems helps you run your finances better. It stops you from doing double work, like entering invoices in two places. You can use FreshBooks for billing and time tracking. Then, use QuickBooks for detailed reports and getting ready for taxes. This ensures all your financial records match up. It creates one clear source of truth for your money matters.

The “Direct Integration” Misconception

It’s important to understand one thing right away. FreshBooks and QuickBooks do not offer a simple, built-in connection. You won’t find a “connect FreshBooks to QuickBooks” button inside either app. This can confuse many users looking for an easy fix.

When we talk about integration, we often mean a direct link built into the software. This uses special connections called APIs. Both FreshBooks and QuickBooks are top accounting software options. They also compete for many of the same customers. This competition might be why they don’t offer a direct bridge between them.

2 Exploring Integration Solutions

0.1Third-Party Integration Tools (e.g., Zapier, IFTTT)

Luckily, other services can help FreshBooks and QuickBooks talk to each other. Tools like Zapier are great for this. They act as a middleman, setting up automatic tasks. You can tell Zapier what to do when something happens in one app.

Zapier uses “Zaps” which are automated workflows. A Zap has a trigger and an action. For example, a trigger could be “a new invoice is sent in FreshBooks.” The action would then be “create a corresponding bill in QuickBooks.” This way, your invoice data moves automatically. Setting up a simple Zap for invoices can save lots of time. Other automation platforms, like Make (formerly Integromat), also offer similar services.

Data Export/Import Methods

You can also move your financial information manually. This means taking data from one program and putting it into the other. It’s not automatic, but it works well for many small businesses. FreshBooks lets you export various financial details. You can get lists of invoices, expenses, or payments.

QuickBooks can accept data imports in different formats, like CSV files. You need to make sure the information lines up correctly. For example, export your invoices from FreshBooks. Save them as a CSV. Then, carefully match each column when you import them into QuickBooks. This method works, but it takes time. You also need to be careful to avoid mistakes.

Using a “Bridge” Accounting System

Some businesses might use a “bridge” accounting system. This is a less common way to link FreshBooks and QuickBooks. It involves a third system that acts as an intermediary. Data flows from FreshBooks to this bridge, then from the bridge to QuickBooks.

This method might be useful for businesses with very unique data needs. For example, if you need to change data in a specific way before it reaches QuickBooks. However, it can add more steps and costs. You also have another system to manage, which can make things more complex.

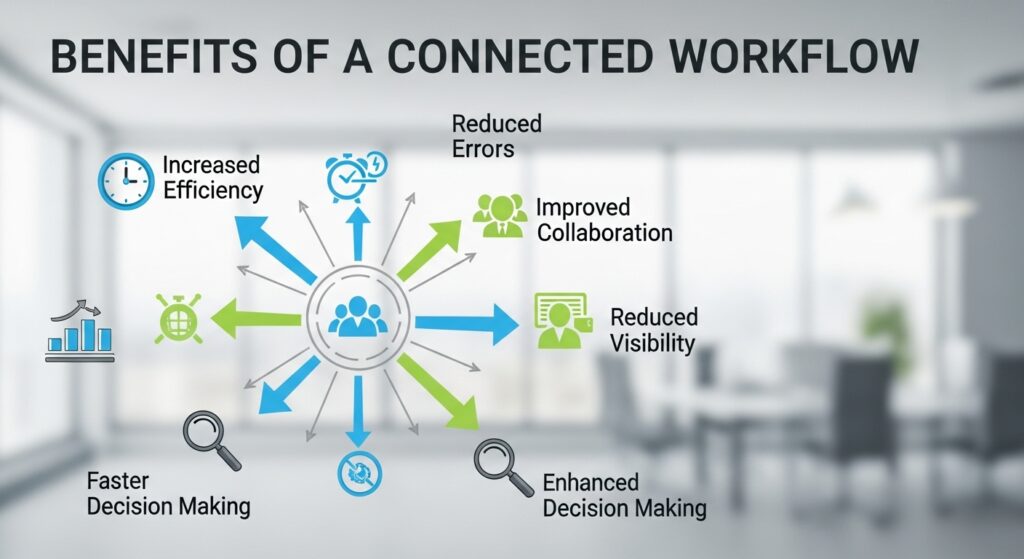

3 Benefits of a Connected Workflow

0.3 Enhanced Data Accuracy and Consistency

Connecting your systems greatly improves your financial records. When you automate data transfer, you cut down on human errors. Imagine not having to type the same invoice details twice. This means less chance of mistakes and types.

Automated syncing keeps your financial records aligned across both platforms. Studies show that automation can reduce data entry errors by as much as 60%. This makes sure your income and expense records are always correct. It helps your business stay on track.

Improved Efficiency and Time Saving

Time is money for any business owner. By automating data movement, you free up hours each week. No more manual data entry lets you focus on growing your business. Reconciliation processes also become much faster.

One small marketing agency reported saving five hours a week by automating their invoice data. This extra time was then spent on client projects and strategy. Automating your financial tasks gives you back valuable time.

Better Financial Insights and Reporting

When FreshBooks and QuickBooks work together, you get a full picture of your money. FreshBooks is great for seeing how profitable your projects are. QuickBooks gives you detailed profit and loss statements. Combining this data gives you a complete view.

You gain a deep look into your business’s money performance. An expert accountant once said, “Unified financial data is the bedrock of smart business decisions.” This holistic view lets you make better choices for your company’s future.

Challenges and Consideration

Data Mapping Complexities

One tricky part of linking FreshBooks and QuickBooks is data mapping. You need to ensure that the information from one system matches the other. For example, a “customer” in FreshBooks must correctly map to a “customer” in QuickBooks. This includes matching service items, tax rates, and payment types.

Before you start, create a clear document for your data mapping. This shows exactly how each piece of information will move. It helps prevent errors and keeps your books tidy. Good planning makes the integration much smoother.

Cost of Third-Party Solutions

Using tools like Zapier comes with a price tag. These automation platforms typically charge a monthly or yearly fee. The cost can change based on how many tasks you automate or how complex your Zaps are. It’s important to look at the pricing models of different platforms.

Think about the return on investment (ROI). How much time will you save? How many errors will you avoid? Often, the cost of these tools is much less than the value they bring in saved time and better accuracy.

Platform Updates and Maintenance

Software updates happen all the time. Changes in FreshBooks or QuickBooks could break your existing integrations. What worked yesterday might not work tomorrow. It is important to keep an eye on your automated workflows.

Stay informed about any API changes from either company. You might need to adjust your Zaps or import settings. Regular checks ensure your data keeps flowing smoothly without interruption.

Best Practices for Integration

Define Your Integration Goals

Before you start any integration, know what you want to achieve. What specific data do you need to move? What is the main outcome you hope for? Do you mainly need invoices to sync, or also expenses and payments?

Decide which platform will be the “source of truth” for different types of data. For example, FreshBooks might be your go-to for client details. QuickBooks might be the ultimate record for your general ledger. Clear goals make the setup much easier.

Start Small and Test Thoroughly

Don’t try to link everything at once. Start with a small, simple integration. Test it with just a few pieces of data. Verify that the information lands correctly in the destination system. This helps you catch any issues early on.

It’s a smart idea to create a test company file in QuickBooks. Use this file for all your initial integration experiments. This way, you don’t mess up your actual financial records while learning the ropes. Roll out the full integration only after successful testing.

Document Your Process

Always write down how you set up your integration. This includes your field mappings and the exact configuration of any automation tools. Note down any special import or export settings you used. Such records are a lifesaver for future reference.

Good documentation helps you troubleshoot problems later. It also makes it easier if someone else needs to manage your financial systems. A well-documented process ensures long-term success.

Conclusion

While FreshBooks and QuickBooks don’t offer direct, native integration, don’t let that stop you. Effective solutions exist to help these two powerful tools work together. Third-party automation platforms like Zapier can create seamless data flows. Manual export and import options provide another way to connect your data.

Remember these key takeaways: Automation tools like Zapier are your best bet for syncing. Manual methods are viable but demand careful attention. Integration brings big benefits like better efficiency, higher accuracy, and clearer financial insights. Always plan well and test your setup before going all-in. Evaluate your specific business needs and choose the integration method that truly helps your finances run smoother and grow stronger.