Best Online Accounting Software for Small Businesses

best online business accounting software

Are you tired of sorting through stacks of receipts? Do manual spreadsheets eat up hours you could spend growing your business? Many small business owners feel stuck in a financial tangle. Old ways of tracking money bring mistakes and a lot of wasted time. It can feel like your business finances are running you, instead of the other way around.

Online accounting software offers a clear solution. This modern tool makes managing your money simple and accurate. It helps you keep tabs on every dollar, from sales to expenses, all in one easy place. You get more time back and feel confident about your business’s financial health.

This guide will show you how to pick the right accounting software. We will cover key features to look for, along with top recommendations. You’ll learn about pricing, important considerations, and how to set things up. Get ready to streamline your financial management and make smarter business choices.

Key Features of Top Online Accounting Software

Choosing the best online accounting software means knowing what features truly help your business. Look for tools that simplify daily tasks and give you clear financial insights. These programs handle more than just numbers; they help your business thrive.

Invoicing and Billing

Professional invoicing shows clients you mean business. Great software makes sending bills quick and easy. This helps you get paid faster, which is good for your cash flow.

- Create and customize invoices with your brand’s logo.

- Set up recurring invoices for regular clients.

- Automate billing schedules so you never miss a payment.

- Link with popular payment gateways like Stripe or PayPal.

- Offer a customer portal where clients view bills and make payments.

Expense Tracking and Management

Keeping track of every penny spent is vital for cost control and tax time. Smart expense tracking helps you see where your money goes. This makes preparing your taxes much simpler.

- Scan receipts using your phone camera and attach them to transactions.

- Connect bank feeds to automatically categorize spending.

- Track mileage if you use your car for business.

- Manage and pay bills directly from the software.

Financial Reporting and Analytics

Clear financial reports are like a map for your business. They show you where you’ve been and help guide future decisions. Good software turns complex data into easy-to-understand insights.

- Generate Profit and Loss statements to see your earnings.

- View Balance Sheets to understand your company’s worth.

- Get Cash Flow statements to track money coming in and going out.

- Use customizable reports and dashboards for a quick overview.

- Prepare tax liability reports to plan for payments.

Bank Reconciliation

Matching your bank statements with your accounting records is key. This step catches errors and prevents fraud. It keeps your books tidy and accurate.

- Use automated bank feeds to import transactions.

- Match transactions with your recorded sales and expenses.

- Quickly identify any differences or missing entries.

Project and Time Tracking

For service businesses, knowing how much time goes into a project is very important. This feature helps you bill clients accurately for your work. It also shows you which projects are most profitable.

- Track time spent on each project or task.

- Analyze project profitability to make smart choices.

- Create client invoices based on tracked hours.

Top Online Accounting Software Recommendations

Many strong options exist for small business accounting. Each one offers different strengths. Consider your business’s unique needs when exploring these popular choices.

QuickBooks Online

QuickBooks Online is a leader in the accounting world. It fits a wide range of small businesses, from startups to growing companies. Most accountants are familiar with it, which can be a big plus.

- Key Strengths:

- Offers a full suite of features for almost any business need.

- Connects with hundreds of other business apps.

- Grows with your business as you add more staff or services.

- Considerations:

- Plans can be more expensive than some rivals.

- New users might find it takes time to learn all its tools.

Xero

Xero stands out for its modern look and user-friendly design. Many small business owners and their accountants love how simple it is to use. Its bank feed connections are particularly strong.

- Key Strengths:

- Easy to learn and navigate.

- Allows unlimited users on all plans, great for teams.

- Has an excellent mobile app for managing finances on the go.

- Considerations:

- Its reporting might not be as detailed for highly complex needs.

- You might need to pay extra for payroll features.

Zoho Books

Zoho Books is part of a large family of business tools. It gives good value, especially if you already use other Zoho apps. This software helps automate many accounting tasks.

- Key Strengths:

- Has budget-friendly pricing options.

- Works smoothly with other Zoho products like CRM.

- Provides strong automation tools to save you time.

- Considerations:

- Connecting with non-Zoho apps can be less flexible.

- Might not have every advanced feature for very complex accounting.

FreshBooks

FreshBooks started by helping freelancers with invoicing. Now, it offers more full accounting features, but invoicing and time tracking remain its strong suits. It’s great for service-based businesses.

- Key Strengths:

- Amazing tools for invoicing and tracking time.

- Has a simple, clean interface that’s easy to grasp.

- Known for its helpful customer support team.

- Considerations:

- Not ideal for businesses that manage a lot of inventory.

- Its reporting might feel basic for some users.

Wave Accounting

Wave Accounting is a free option perfect for very small businesses or freelancers. If you’re just starting out and have a tight budget, Wave is an excellent choice for basic needs.

- Key Strengths:

- Free for accounting, invoicing, and receipt scanning.

- Offers a straightforward and easy-to-use interface.

- Considerations:

- Features are limited compared to paid services.

- Most customer help comes from online articles or email.

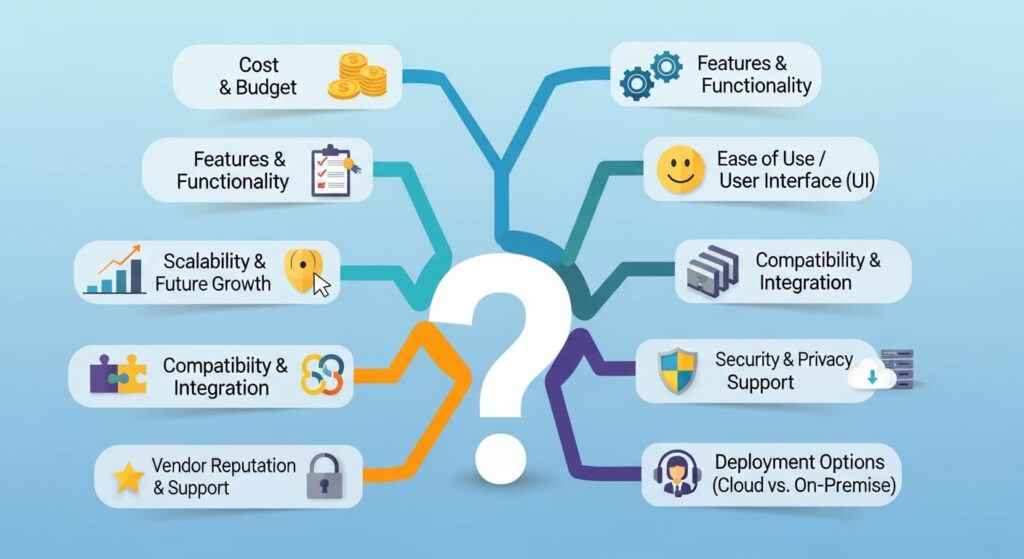

Factors to Consider When Choosing Software

Finding the right accounting software means looking at more than just the price tag. Your business is unique, and your tools should fit its needs perfectly. Think about how the software will help you grow.

Business Size and Complexity

The best software for a solo freelancer might not work for a growing company with employees. Pick a tool that matches your current business size and how complex your finances are.

- Count how many transactions you handle each month.

- Think about your business growth plans for the next few years.

- Check if your industry has special accounting rules.

Budget and Pricing Structure

Understand all costs involved, not just the monthly fee. Some plans charge extra for more users or advanced features. Free trials are a good way to test before you commit.

- Compare monthly subscription costs versus annual plans.

- Look for any hidden costs, like setup fees or extra support charges.

- Use free trials to see if the software feels right for you.

Ease of Use and Learning Curve

The best software should make your job easier, not harder. You want a tool that your team can learn and use without frustration. Simple navigation is a big plus.

- Choose software with clear, intuitive menus and simple steps.

- See what training videos or guides the company offers.

- Consider who will use the software daily and their comfort with new tech.

Integration Capabilities

Your accounting software should talk to your other business tools. Does it connect with your online store, customer management system, or payroll service? Good connections save time and prevent manual data entry.

- Check for links with your CRM, e-commerce platform, or payroll service.

- Make sure it syncs well with your business bank accounts.

Scalability and Future Needs

Your business will likely change and grow. Choose software that can keep up with those changes. You don’t want to switch systems every year.

- Can you easily upgrade to higher plans with more features later?

- Does the software support multiple users or different office locations if you need them?

Getting new accounting software is a big step. A smooth start means less stress later. Follow these tips to set up your new system for success.

Data Migration and Setup

Moving your old financial information to the new system needs care. A good setup ensures your records stay accurate. Take your time with this important step.

- Always back up all your old financial data before moving it.

- Set up your chart of accounts to fit your business from day one.

- Carefully import historical data and double-check everything for accuracy.

Training and Team Adoption

Everyone who uses the software needs to feel comfortable. Good training helps your team learn the new system quickly. It makes sure everyone uses it the right way.

- Watch vendor training videos and read their guides.

- Hold quick training sessions for your team.

- Pick one person to become the expert on the new software.

Regular Review and Optimization

Accounting software isn’t something you install and then forget. Check in with it regularly. Look for ways to use more features and improve your financial tracking.

- Schedule regular times to review your financial reports.

- Learn about new features as you get more comfortable with the basics.

- Stay updated on software improvements and new tools.

Conclusion

Choosing the best online accounting software is a smart move for any small business. It brings efficiency, accuracy, and clear insights to your finances. Imagine saving hours each week and having a real-time view of your money. That’s the power of the right accounting tool.

To recap, think about what features you need most for your business. Weigh your budget against ease of use and how well the software connects with your other tools. Remember, a good setup and team training are key to making it work well. Don’t wait to make your financial management easier. Explore these top accounting software options today and choose the one that fits your business perfectly.